$20 million in loans have been funded to date through P2P lending marketplace darling Prosper, not bad given that the site launched publicly less than nine months ago. But is it working? How are these loans performing?

$20 million in loans have been funded to date through P2P lending marketplace darling Prosper, not bad given that the site launched publicly less than nine months ago. But is it working? How are these loans performing?

In another victory for transparency (the first being that borrowers willingly consent to having their credit ratings posted publicly), Prosper also makes default statistics publicly available.

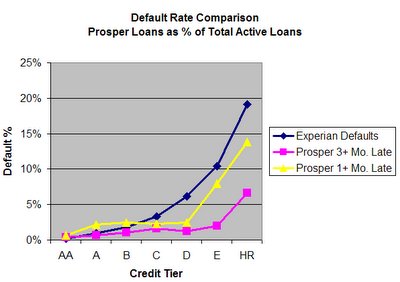

Below is a simple analysis comparing Experian default rates by credit tier to the percentage of Prosper loans that are 1+ months late and 3+ months late on a payment.

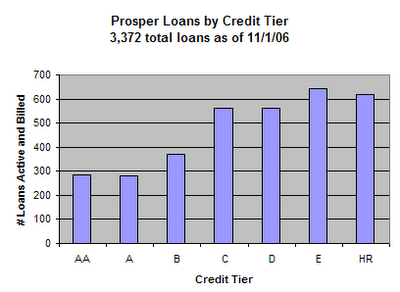

Although the news appears to be encouraging, since Prosper currently only has 3,372 loans active and billed (below), it is really too early to form definitive conclusions. From this early data, Prosper loans seem to outperform traditional loans in the C, D, E and HR credit tiers, but under-perform traditional loans in the higher credit tiers, AA, A and B. Outliers, potentially fraudulent activity and really just too little data and too short of a track record are influencing these numbers, however it will be interesting to see if the trend can be maintained.

Wednesday, November 01, 2006

P2P Finance - Does it work?

Posted by LaBlogga at 4:28 PM

Labels: affinity capital, p2p finance, propser, social finance

Subscribe to:

Post Comments (Atom)

Email me

Email me Twitter

Twitter MS Futures Group

MS Futures Group Data Visualization Wiki

Data Visualization Wiki Economic Fallacies

Economic Fallacies

2 comments:

Prosper loan volume has been exponentiating; $20M to date with $4M in October 2006

Good points, Kevin, I think transparency is critical to the Prosper/P2P lending model being able to work and could also lower default rates, especially if repayment reputation is incorporated for individuals instead of just groups.

Post a Comment