Two conferences held in San Francisco last week underline key future trends, the crowdsourcing of work (and maybe everything), and hyper-local mobile-phone based services such as payments. Thematically, crowdsourcing and mobile services both deal with quantization – the idea of resources being granularized to the smallest unit, and then directed fungibly and automatically to where they are needed and requested, like routing internet data packets. In this case labor units and targeted personalized mobile services can be delivered on a quantized basis. Market principles continue to seep into life with quantization models which typically provide superior value creation and exchange.

Two conferences held in San Francisco last week underline key future trends, the crowdsourcing of work (and maybe everything), and hyper-local mobile-phone based services such as payments. Thematically, crowdsourcing and mobile services both deal with quantization – the idea of resources being granularized to the smallest unit, and then directed fungibly and automatically to where they are needed and requested, like routing internet data packets. In this case labor units and targeted personalized mobile services can be delivered on a quantized basis. Market principles continue to seep into life with quantization models which typically provide superior value creation and exchange.

Crowdsourcing

CrowdConf2011 (November 1-2, 2011) was bigger and broader than CrowdConf2010. The main focus continued to be on crowdsourced labor, but these models are also emerging in e-government, consumer travel, entertainment, fundraising, and philanthropy (and health, though not included at CrowdConf). Software, professional services (i.e.; graphic design) and R&D have long been staples of crowdsourced labor, and these models are now being extending to almost all areas of the enterprise including sales, social CRM (customer relationship management) and finance, accounting, and administration.

Mobile-phone based services

Mobile is the platform. One billion smartphone users are expected by 2013 and app downloads grew explosively from 300 million in 2009 to five billion in 2010. Arguably, the mobile phone has become an indispensable human augmentation accessory: the loss of a phone is noticed within five minutes, versus the loss of a wallet which takes an hour. The intimate continuous connection individuals have with their mobile phones suggests the platform as a critical delivery mechanism for many important future services such as mental mood performance optimization.

Geo-Loco (November 3, 2011) focused on hyper-local mobile services delivery. The biggest growth area is mobile payment programs where the prevailing methods in use are 2-D barcodes (as used in Starbucks smartphone apps) and NFC (near field communication) chips which send encrypted data over short distances. The development of corporate and brand marketing strategies for mobile services delivery was another big focal area. The poster-child of success of branded smartphone apps, from Starbucks, allows payments, store locating, and checking nutritional information. Ironically, drinks can be configured out of 85,000 possibilities and shared with friends, but not actually ordered!

Sunday, November 06, 2011

Quantization trends of the future: crowdsourcing and geolocation

Posted by LaBlogga at 11:21 AM View Comments

Labels: affinity capital, apps, automatic markets, community-based, crowdsourcing, fungibility, Future of work, granularity, market principles, mobile, quantization, quantized resources, smartphone, telecom

Sunday, October 19, 2008

Can social capital markets move from niche to core?

The 700+ participants in this week’s first of its kind Social Capital Markets conference think so. Session summaries are available here. Social Capital Markets tend to denote markets and economic transactions where not only financial but also social and environmental aspects are of concern.

The 700+ participants in this week’s first of its kind Social Capital Markets conference think so. Session summaries are available here. Social Capital Markets tend to denote markets and economic transactions where not only financial but also social and environmental aspects are of concern.

Right now there are three significant factors impacting the development of social capital markets:

First, the current failure of traditional capital markets models. We are in a moment of refashioning the global economy and the values and principles of social capital markets are being demanded: accountability, transparency, sustainability and governance. Social capital markets companies have a great opportunity to step in and help build the new world economic order.

Second, a broad social consciousness has developed. It started with Al Gore, Paul Hawken and others. Like all human behavior, economics is another area where deep awareness about the social and environmental impact of actions is necessary and increasingly available. Further, there is the idea of using the principles of business and economics as a tool for change; getting developing world populations actively involved as entrepreneurs receiving microloans has been vastly more successful in alleviating poverty than 30 years of foreign aid programs.

Third, the tools are now in place for realizing social capital markets. Web-based marketplace platforms and offerings are available for all manner of social economic transactions including investing (SRI public equity, social venture capital, debt, loans, microfinance, real estate and prediction markets), philanthropy (from donations to mission-related investments), purchasing (goods and services marketplaces) and income generating (jobs, projects and ideas marketplaces). Granular attribute selection can be used to allocate capital which makes transactions more empowering for all participating parties.

In summary, the three factors driving the next stage of Social Capital Markets, new models for rebuilding traditional capital markets, the development of a broad social consciousness in support of green markets and the tools to execute and monitor these transactions, could help the area evolve from niche to core.

The true moment of progress could come when Social Capital Markets are no longer distinct from traditional capital markets but are rather merely a feature or attribute of all capital markets.

Posted by LaBlogga at 8:54 AM View Comments

Labels: affinity capital, conscious capital, green markets, impact investing, market transformation, socap2008, social capital markets

Sunday, August 24, 2008

Economic fallacies II

Fallacy #3: The singularity is a great investment opportunity

Fallacy #3: The singularity is a great investment opportunity

A technological revolution like that brought about by the PC or the Internet is a great investment opportunity. Current possibilities for this kind of compound growth in technology-driven financial returns include alternative energy, genomics, personalized medicine, anti-aging therapies, 3d data manipulation tools and narrowly-applied artificial intelligence.

A technological singularity is not necessarily a great investment opportunity. A technological singularity implies change so radical and diffuse that prior models for understanding and exploiting or profiting from the world will no longer work. There is a substantial risk that financial markets as they are known today could disappear. Growth, alpha and superior financial returns may be irrelevant in a post-traditional financial markets era. Planning for the possibility of a technological singularity suggests a much broader definition of what the assets of the future may be and allocating to these areas, a substantial shift away from the traditional asset preservation and financial returns that outpace inflation in the long-run mindset of today.

Fallacy #4: Economic systems become irrelevant in a post-scarcity economy

This is the notion that economies and markets go away in a post-scarcity economy for material goods. At present, an increasing number of goods and services are becoming available for free or offered via modern business models such as the freemium. In the future, substantially all material needs may be easily met at low cost or for free in a molecular-nanotech society, but scarcity as an economic dynamic is likely to persist and economics systems in general are also likely to continue.

Scarcity would be perceived in whatever material resources were not yet plentifully available and in any finite resources such as time, ideas, attention, emotion, reputation, quality, etc. Economic system dynamics could change substantially, for example, property tax would not make sense in a world where nanotech could rapidly build or absorb structures. Unless economics and markets as the most effective means of resource distribution are superceded, they are likely to endure.

Fallacy #5: Social capital markets need not deliver competitive returns

The conventional notion is that it is acceptable for social capital market investments to deliver lower returns than traditional financial instruments. Social capital market investment products include SRI equity funds, corporate governance initiatives, social capital venturing (private equity), fair trade coffee and organic products. On average, consumers are willing to spend 5% more for attribute products (products with affinity attributes such as fair trade, local, organic, etc.) and investors have been willing to sacrifice 5% or more in financial return for socially responsible investments.

However, after some implementation time lag, social capital could have equal or higher returns. Sustainable socially responsible businesses should be more profitable not less. Both direct tangible economic benefits can accrue as well as the indirect benefits of marketing and market-knowledge that the business is more principled and sustainable. Corporate governance and other green or social initiatives should benefit the bottom line, not penalize it. The notion that return and social good are mutually exclusive is a fallacy.

The article with all nine fallacies is available here

Posted by LaBlogga at 8:04 PM View Comments

Labels: affinity capital, corporate governance, fallacies, freemium, future economics, investing, molecular-nano, post-scarcity economy, scarcity, singularity, social capital, SRI, technology economics

Thursday, January 17, 2008

Capital markets 2.0

In the last few years, a variety of innovative capital markets have arisen to supplement and extend traditional large institutional capital markets. The new markets fill niches of demand for capital and investment, and allow greater granularity of investment information and capital direction. The currency may be money, reputation, ideas, social good or any combination of these. Some of the new capital market vehicles include:

In the last few years, a variety of innovative capital markets have arisen to supplement and extend traditional large institutional capital markets. The new markets fill niches of demand for capital and investment, and allow greater granularity of investment information and capital direction. The currency may be money, reputation, ideas, social good or any combination of these. Some of the new capital market vehicles include:

- Virtual World Economies (Second Life, There, Entropia Universe, World of Warcraft),

- Peer-to-Peer Lending (Prosper, Zopa, Lending Club),

- Micro-Lending (Kiva, Grameen Bank, Accion),

- Social Capital Markets and Venture Philanthropy (GoodCap, Blended Value, New Profit),

- Ideagoras (Innocentive, The Point, Zooq) and

- Prediction Markets (Iowa Electronic Markets, Intrade, ZiiTrend).

"As of January 22, 2008, it will be prohibited to offer interest or any direct return on an investment ... without proof of an applicable government registration statement or financial institution charter. (Full text here)"

Risk, Cost of Capital and Acceptable Return

One value of the new markets is that they provide capital in cases that are less attractive or irrelevant to traditional financing entities. These situations often have dramatically different risk, growth and timescale profiles than traditional investments and are conceptually similar in many ways to doing business in a high risk country.

The risk is higher, so the return too must be higher in compensation. Looking at annualized interest rates may not make sense in the accelerated time environment of virtual worlds where the economy (as measured by land and money supply) is currently growing 6% per month in Second Life.

What is an appropriate cost of capital? Anecdotal interest rates on Second Life loans have ranged from 7% per month to nearly 50% per month, and experienced a 20-30% default rate. This is the cost of capital for people who do not want to declare their physical identity details or seek other means of capital. In the physical world, it is not unusual for payday lenders to charge 300%+ per year to cover their high default rates. Peer-to-peer lender Prosper found that U.S. state-based usury laws did not allow the site to charge enough interest to cover subprime borrower defaults.

Virtual economies are chided for not having sustainable interest rates at the same time as the subprime lending crisis is crescendoing through physical world capital markets, itself a reprise of the 1980s RTC crisis.

Law, Regulation and Jurisdiction

The appropriate norm is to comply with traditional governing entity rules and laws, including being flexible with business models in order to do so. Peer-to-peer lenders had to structure their businesses in specific ways to obtain licensing and comply with U.S. usury laws which vary by state.

Virtual world economies will likely need to be even more innovative to receive physical world approvals. The pervasively global and anonymous virtual world medium suggests that geographically-based physical world regulation will be challenging to apply in reasonable and effective ways. However, anonymity is probably less important as an attribute for virtual capital seekers, as when a benefit is conferred, people are generally willing to give up anonymity. For example, peer-to-peer lenders found that people are perfectly willing to have their credit reports posted publicly on the Internet in return for the ease of potentially obtaining a loan.

In addition to traditional law and regulation, new capital markets may face another layer of compliance in the form of specific in-medium practices that develop. Complying with in-medium practices is important both reputationally and in the instance of in-medium adjudication and dispute resolution mechanisms.

Posted by LaBlogga at 8:46 PM 1 comments

Labels: affinity capital, banking crisis, ideagoras, markets 2.0, P2P lending, prediction markets, prosper, second life, self-governance, social capital, social finance, virtual economies, virtual worlds

Monday, November 19, 2007

Prosper reaches $100 million in loan volume

Peer-to-peer lending company Prosper reached a benchmark $100 million in loan volume this week. With the US stock market declines, credit crunch, raising gas prices and ailing economy, borrowers are turning to novel forms of credit such as fledgling peer-to-peer capital platforms offered by Prosper (US), Lending Club (US) and Zopa (UK).

Peer-to-peer lending company Prosper reached a benchmark $100 million in loan volume this week. With the US stock market declines, credit crunch, raising gas prices and ailing economy, borrowers are turning to novel forms of credit such as fledgling peer-to-peer capital platforms offered by Prosper (US), Lending Club (US) and Zopa (UK).

$100 million in loan volume is an important benchmark, however the overall growth rate of new Prosper loans is slowing as the chart below indicates. Prosper's loan volume grew from essentially zero at the beginning of 2006 to $100 million in November 2007 but the S-curve inflected earlier this year at the $50 million loan volume mark.

Source: Prosper performance data. Note: the default view which specifies 0 delinquencies and 0-2 credit checks in the last 6 months should be removed to view the total loan portfolio.

The reason that Prosper loan growth is slowing is the same subprime credit challenge facing large financial institutions and the US economy as a whole. Initially, high interest rates attracted individuals willing to lend to subprime borrowers to the Prosper platform, but many of them have experienced high default rates and withdrawn their capital or curtailed their lending strategies.

Below is Prosper's ROI by credit tier, comparing the annual return for the year ending September 30, 2007 with the year ending August 31, 2007. Negative returns can be expected for credit tiers D, E and HR (high risk), while even the C tier has now slipped to a zero ROI. Prosper continues to be exclusively appropriate for investing in high credit quality, tiers AA, A and B, where the 6-9% ROI is still attractive relative to other investments, however perhaps becoming more risky.

Source: Prosper performance data.

Posted by LaBlogga at 7:25 PM 3 comments

Labels: affinity capital, debt, loans, p2p finance, P2P lending, propser

Sunday, September 30, 2007

Prime investing with Prosper

Leading P2P lender Prosper has executed an impressive $90 million in loans through its marketplace but continues to remain appropriate only for those wishing to invest in high prime credit quality consumer debt.

Leading P2P lender Prosper has executed an impressive $90 million in loans through its marketplace but continues to remain appropriate only for those wishing to invest in high prime credit quality consumer debt.

10% of the roughly 2,500 loans listed on the site at any time are in the high prime tier (credit ratings AA, A and B), in fact, most of the listed loans do not fund. About a third of the loans that fund and become active and billed are in the high prime credit tier.

The graph below shows an ROI comparison of Prosper's total loan portfolio by credit rating in two time snapshots, August 30, 2005 - August 30, 3006 in blue and August 30, 2006 - August 30, 3007 in yellow. In the last year, AA, A and B loans funded at 11-15% and have an ROI of 6.5-9.5% once adjusted for default. Source: Prosper performance data. Note: the default view which specifies 0 delinquencies and 0-2 credit checks in the last 6 months should be removed to view the total loan portfolio.

Source: Prosper performance data. Note: the default view which specifies 0 delinquencies and 0-2 credit checks in the last 6 months should be removed to view the total loan portfolio.

Acceptable Returns?

Is 6.5-9.5% an appropriate return? It depends on a full consideration of the risk and return profile of the investment. Theoretically, high prime consumer credit loans are low risk; the historical default rate for Prosper loans has been 2% for AA and A loans and 4% for B loans. As compared with the stock market, which has on average for the last 80 years delivered a pre-tax return of 8% with a higher level of risk, Prosper loans look more attractive. 6.5-9.5% also provides a healthy risk premium over risk-free t-bills or money market funds and CDs which are currently yielding about 4.5%.

Posted by LaBlogga at 7:34 AM 2 comments

Labels: affinity capital, markets 2.0, p2p finance, P2P lending, prosper

Wednesday, November 01, 2006

P2P Finance - Does it work?

$20 million in loans have been funded to date through P2P lending marketplace darling Prosper, not bad given that the site launched publicly less than nine months ago. But is it working? How are these loans performing?

$20 million in loans have been funded to date through P2P lending marketplace darling Prosper, not bad given that the site launched publicly less than nine months ago. But is it working? How are these loans performing?

In another victory for transparency (the first being that borrowers willingly consent to having their credit ratings posted publicly), Prosper also makes default statistics publicly available.

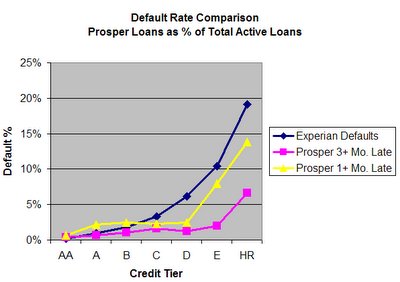

Below is a simple analysis comparing Experian default rates by credit tier to the percentage of Prosper loans that are 1+ months late and 3+ months late on a payment.

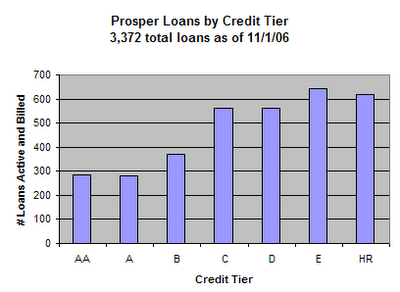

Although the news appears to be encouraging, since Prosper currently only has 3,372 loans active and billed (below), it is really too early to form definitive conclusions. From this early data, Prosper loans seem to outperform traditional loans in the C, D, E and HR credit tiers, but under-perform traditional loans in the higher credit tiers, AA, A and B. Outliers, potentially fraudulent activity and really just too little data and too short of a track record are influencing these numbers, however it will be interesting to see if the trend can be maintained.

Posted by LaBlogga at 4:28 PM 2 comments

Labels: affinity capital, p2p finance, propser, social finance

Monday, October 23, 2006

Markets 2.0 - Social Finance. Affinity Markets.

The long tail, smart mobs and social networking are driving the evolution of economics to Markets 2.0. Social networks have been important venues for self-expression and interaction and now, with an increasingly linked online populace, are starting to add a new and important functionality, virtual aggregation for group power, both economic and political.

The long tail, smart mobs and social networking are driving the evolution of economics to Markets 2.0. Social networks have been important venues for self-expression and interaction and now, with an increasingly linked online populace, are starting to add a new and important functionality, virtual aggregation for group power, both economic and political.

Two key concepts in Markets 2.0 are Social Finance and Affinity Markets. Social Finance is the virtual aggregation of dozens, hundreds or millions of people for the purpose of conducting an economic transaction. Social Finance is also known as crowd funding and crowd sourcing.

Affinity Markets are marketplaces where transactions can occur based on affinity attributes. Not just is the sweater red, woolen and made in China (legacy attributes) but under what conditions was it made, were renewable materials used, did female entrepreneurs make it (affinity attributes). Affinity Markets are also known as directed capital, cause-based capital and (in online aggregations) virtual affinity groups.

Markets 2.0 have the ability to completely disintermediate traditional financial institutions by providing instantaneous, cheaper, directed capital with more effective results.

What will it be like when people can get their mortgage and home equity loans online from peer finance, when anyone can have a local portfolio manager for commodities in India, when million-member virtual BuyGroups bid for insurance and healthcare services, when synthetic economies nominate and finance virtual candidates for physical world office, when Socially Responsible Debt means that states without measurable social progress cannot get their bond offerings financed?

Read more...

Posted by LaBlogga at 1:29 AM 0 comments

Labels: affinity capital, democratization of capital, markets 2.0, prosper, social finance

Email me

Email me Twitter

Twitter MS Futures Group

MS Futures Group Data Visualization Wiki

Data Visualization Wiki Economic Fallacies

Economic Fallacies