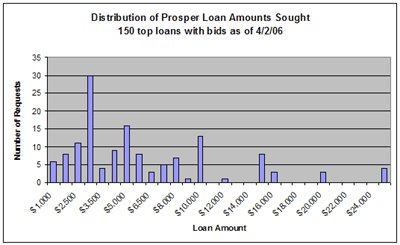

How liquid is the Prosper lending marketplace? About 2% of the currently listed 750 loans are fully funded and about 40% of the loans have more than one bid. This might sound low, but while the ratio of fully funded loans is generally unchanging at the moment, the number of loans receiving bids is substantially up, even in the last week. Understated interest rates are the primary culprit causing the vast majority of the nearly 5,000 loan listings to date to come and go with no bids despite multiple listing attempts. Diverse amounts for all credit tiers are receiving funding if the interest rate is right, although the fully funded loan of $5,000 is being received by AA-C credit tiers. Below is an indication of the current loans that are receiving bids by size, $3,000 is the average loan size requested.

How liquid is the Prosper lending marketplace? About 2% of the currently listed 750 loans are fully funded and about 40% of the loans have more than one bid. This might sound low, but while the ratio of fully funded loans is generally unchanging at the moment, the number of loans receiving bids is substantially up, even in the last week. Understated interest rates are the primary culprit causing the vast majority of the nearly 5,000 loan listings to date to come and go with no bids despite multiple listing attempts. Diverse amounts for all credit tiers are receiving funding if the interest rate is right, although the fully funded loan of $5,000 is being received by AA-C credit tiers. Below is an indication of the current loans that are receiving bids by size, $3,000 is the average loan size requested. Approximately 60% of Prosper's borrowers are in the HR (high risk) or NC (no credit) tier, for which the market interest rate Proper suggests is 24-31%. However, half of the 46 states in which Prosper is licensed have maximum allowed interest rates of 16% or less (including the large markets of NY, NJ, IL, PA and VA) suggesting that over 80% of borrowers (credit tiers D, E, HR and NC) in half of the company's markets cannot borrow. Even the highest rated borrowers, AA with zero existing debt, are suggested to request their loans at 7-9% which seems a bit steep.

Approximately 60% of Prosper's borrowers are in the HR (high risk) or NC (no credit) tier, for which the market interest rate Proper suggests is 24-31%. However, half of the 46 states in which Prosper is licensed have maximum allowed interest rates of 16% or less (including the large markets of NY, NJ, IL, PA and VA) suggesting that over 80% of borrowers (credit tiers D, E, HR and NC) in half of the company's markets cannot borrow. Even the highest rated borrowers, AA with zero existing debt, are suggested to request their loans at 7-9% which seems a bit steep.There are a few easy steps that could probably significantly improve the ratio of loans funded. First, better loan listings would help. Borrower listings are failing to interest the site's significant amount of deposited lender funds primarily because the requested rates are too low. The required rates may decrease over time as the reputation and repayments of borrowers are posted on the site but at the outset lenders are requiring a higher risk premium. Examples of successful listings, community mentoring and standard features like spellchecker and preview would hopefully increase borrower marketability.

Making the lending process more like an actual market, specifically allowing full flexibility on the interest rate, would also improve liquidity. Lenders should be able to specify their rate for bidding on the listing, above or below the borrower's requested rate. Borrowers should be able to revise their listing to a higher interest rate in process or choose to accept a higher rate at which their loan could be fully funded. The site should eliminate trial and error and allow the market to decide the rate. The rates borrowers want to pay are too low for the current Prosper marketplace.

Over time metrics may emerge that better reflect a borrower's repayment capability than credit ratings and DTI scores, reputation and repayment history as well as other ways an erstwhile borrower could signal to prospective lenders. Lenders could use these alternative metrics to have more comfort and trust in loan listings and bidding liquidity would improve.

As of last week, a rate cap of 24% has been imposed on prosper lending -- motivated in part by perhaps reasonable (though ill communicated) beliefs on the part of Prosper staff (mostly fear of adverse selection among HR borrowers looking for Prosper loans). In the short run, this has the effect of shutting out most HR borrowing, given that they possess a 19.1% default rate (and that return adjustment for risk is necessary to convince lenders to lend).

ReplyDeleteHi cellardoor, thanks for the comment. A rate cap makes sense but does lock out a substantial part of the borrower market. There are currently several listings on Prosper at 35% and otherwise over the 24% cap so the cap must be for new listings. I would like to see statistics on the 19.1% default rate you mention for HR borrowing and think there are ways to improve this with the P2P lending platform.

ReplyDelete